FinTech – the safety of financial apps and systems

One may see fintech as a revolutionary solution in the financial market. How about you?

9 min read

In this Article:

- What are the main benefits of using fintech to manage your finances?

- Why have AI chatbots become a must-have to provide quality and effective customer service?

- How can Fintech solutions help us to learn our spending habits?

The process lasts for quite a long time. In the beginning, it could have been seen as a casual alternative to old, well-checked banking methods. Now, considering the instant development of technology, it’s safe to say that it’s bound to seize the throne. Traditional financial companies have already noticed it – the vast majority (88%) of them expect to lose an important part of their income to independent fintech firms.

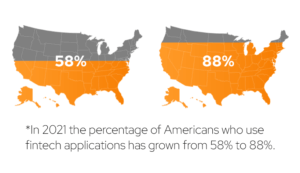

It’s because we’re experiencing the moment when more and more people cannot imagine any other way to manage their finances – store money, make transactions, analyze financial data, and so on. Let’s take the US as a perfect example. According to the report made by Plaid, in 2021 the percentage of Americans who use fintech applications has grown from 58% to 88%. That’s an outstanding result. And, as demand and supply affect each other, the US is currently the country where 64% of the 250 most promising fintech startups are located.

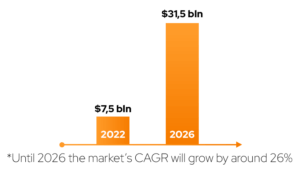

The growing trust in fintech affects the general value of this branch of industry. According to The Global Fintech Market Report published in October 2021, Fintech companies are already worth around 7.5 billion USD. If that number is shocking enough, then it’s hard to find a proper adjective to describe the forecast. The report says that until 2026 the market’s CAGR will grow by around 26.87%. So, the predicted value is around 31,500 billion USD! It has a strong connection with artificial intelligence. More on this subject later.

OK, so now the first general thought is coming to one’s mind – what are the reasons for that phenomenon? In this article, we’ll list the most important ones along with the main benefits of using fintech to manage your finances. All are closer or further to one main idea – your money is just safe.

The correlation with AI

Let’s start with the already mentioned case. The given report proves that it has become crucial for fintech developers to use AI e.g. for collecting data, analyzing it, and consequently creating customer-friendly products (mobile apps, financial systems, etc.). Therefore, the value of fintech grows in parallel to the value of AI. This is why the huge predictions in the report are explicable. There is one core of a successful and trustworthy fintech product. The creators aim to avoid the threat of losing customers’ confidential data. One small negligence can make a fintech app a platform to make constant financial frauds. AI solutions help in two crucial tasks – to estimate the risk of losing the data and to detect any potential fraud at the initial stage.

AI chatbots also become a must-have to provide quality and effective customer service in banks and other financial institutions. It’s beyond human capability to handle as many clients as it happens with the usage of this technology. There is a strong voice that dealing with automatic responses cannot be compared to building a customer relationship with an agent. However, the growth of artificial intelligence is so dynamic that until 2023 it will be even more difficult to spot the difference. Chatbots can easily adjust to customer needs, come up with quick and exhaustive service, and move straight to the next person in the waiting line. Suffice it to say, bank employees are predicted to save 826 million work hours in 2023 thanks to chatbot interactions. The majority of these conversations (79%) will be done in well-developed mobile apps.

Fintech as the perfect insurance tool

Finances are a wide field of knowledge and activity. Fintech solutions are capable of improving each part of it. Let’s go through them one by one. Fintech has been considered a well-demanded thing in the insurance industry as early as in 2017 when the International Association of Insurance Supervisors (IAIS) published a report of Fintech Developments in the Insurance Industry. The report took into consideration 3 different scenarios, including pessimistic ones.

However, it’s a positive view that finds its reflection in the current reality – the process even has its own term: insurtech. According to the report published by Statista in January 2022, the financing of insurtech companies is big again after the decrease caused by the COVID-19 pandemic. The activity reached around 4.8 billion dollars in the 2nd quarter of 2021, which is almost twice as high in comparison to the 1st quarter of the previous year.

Customers tend to trust insurance companies supported by emerging technologies for one main reason. AI solutions use algorithms that provide them with flexible personalized offers. It includes things they should insure, pricing, payment method, etc. This is how they can adjust the matter of insurance to their everyday lifestyle.

Borrow some money more quickly with Fintech

Fintech money lenders are increasingly more visible in the financial market. It’s one of these branches that paradoxically benefited from the pandemic. Numerous small and medium businesses have decided that the only way to survive the most critical period is to go for an alternative way of borrowing money. Speed, accessibility, and flexibility are among the most frequently mentioned advantages of this solution.

It works well for the other side, too. According to World Bank, fintech platforms have an unprecedented opportunity to assess the creditworthiness of a potential borrower in a quick and convenient way. All thanks to the innovative way of storing and examining data. Therefore, the negotiations are transparent from the very beginning. If the agreement is made, both sides have a complete overview of any changes.

There are some opinions that there is still some room to develop this side of the fintech industry. The dissenting voices include the ones that it’s pointed towards weak businesses, the investors are unstable, or it still has limited capability of getting valuable information about retail customers in comparison to banks. But, it’s time to face the facts – the number of trustworthy applications led by fintech lenders proves that this branch of the industry stays strong and it’s not going to change any time soon.

Use Fintech to manage your personal finances

Fintech solutions aren’t totally about insurances, loans, and other one-time crucial decisions on our finances. It also works in our favor with the everyday control of our bank accounts, regular transactions, saving money, etc. There are fintech apps that help in all these areas.

For example, budgeting for a specified period is one of the activities that require engagement and an organized structure. It works similarly for both personal and business finances. Fintech apps give us a hand here. They usually have a user-friendly language and digital platform that helps us with planning our budget, controlling it, and summarizing our efforts. Plus, we can count on several features that do all the thankless work for us (billings, payments, etc.), so all we need to do is to check whether everything works well. Fintech solutions also help us to learn our spending habits. There are applications that keep a record of our expenses and update them regularly. This is how we can see everything, let’s say on a monthly basis, and draw some fruitful conclusions about what to continue and what to avoid in the future.

Fintech gives a new breath to finances

As I promised at the beginning, you can clearly see that fintech is a technology that allows us to stay calm about our money. It’s already strongly correlated with multiple AI solutions. Considering the dynamic growth of this side of technology, it’s abstract to imagine the incoming changes in this field.

However, the new tangible signs appear one after another to prove that the two things are safe. First, our finances are safe. Second, it’s safe to say that with this progress and predicted value traditional banking is bound to be dominated by fintech within the next decade, if not 5 years. Do you want to take a bet on that? Or you have any questions considering the importance of fintech in the global financial market? It’s your time to share your thoughts, I’d respond with great pleasure.